Shared Parental Leave: Sharing or splitting up leave

Shared Parental Leave (SPL) gives parents greater flexibility in how they care for their child. SPL allows birth mothers to share a portion of maternity leave and pay with their partners to care for children from birth until their first birthday. SPL can also be used by the birth mother alone to allow her to return to work for periods in between periods of SPL, this flexibility does not exist with Maternity Leave. SPL can also be used by parents who are adopting or having a baby through surrogacy.

This article provides guidance on how to share and split up Shared Parental Leave (SPL) and Pay (ShPP). For more information, see our other articles on Shared Parental Leave: Overview and eligibility for leave.

Note: The provisions for adopters and parents of a child born through surrogacy are very similar so for simplicity we only refer in this article to parents (birth parent and partner), which includes same-sex couples. For more information, see our article on Shared Parental Leave for parents using adoption or surrogacy.

How much leave can be shared?

The first 2 weeks of maternity and adoption leave are compulsory for the birth mother for health and safety reasons (4 weeks if they work in a factory). Eligible parents can therefore take up to 50 (or 48) weeks as Shared Parental Leave (SPL), and up to 37 weeks of Shared Parental Pay (ShPP).

How much SPL or ShPP eligible parents can take depends on how much leave the birth parent has taken.

A common error which we hear about on our Helpline is that people are told by their employer/HR, or even other advisors, that both parents cannot be off and being paid at the same time.

That’s not correct advice for the statutory scheme.

You can take SPL at a different time from your partner/other parent, or at the same time. For example, a woman can be on maternity leave and her partner can be on SPL at the same time. It is also possible for just one parent to take SPL. There is no requirement for both parents to take SPL and indeed, only one parent may qualify to take SPL.

How shared leave may be taken

How and when leave and pay are shared is up to the parents, as long as the leave is taken within the first year after birth of the child and as long as the regulations are followed.

So – to summarise – both partners can be off together, e.g. on maternity leave and SPL at the same time (both being paid), or at different times, e.g. one after the other or just one parent can take SPL.

For information on eligibility if circumstances change or if the birth parent is not entitled to maternity leave see our page on eligibility here.

If you have any questions about this, please call our advice helpline.

How to ‘create’ Shared Parental Leave

Shared Parental Leave is created when the birth partner ends (‘curtails’) her maternity leave, to create an amount of leave available to her partner to take as SPL and ShPP.

If the birth parent is not entitled to maternity leave (for instance, she is a worker or is self-employed), she can create SPL by ending her Maternity Allowance early. In practice the notice must be given on or before the 38th week, in order to create SPL for her partner. Should she fail to do so, she will not be able to create SPL or ShPP for her partner. The number of weeks of Maternity Allowance taken must be deducted from 52 weeks to calculate the number of weeks of SPL that will be available for her partner to take.

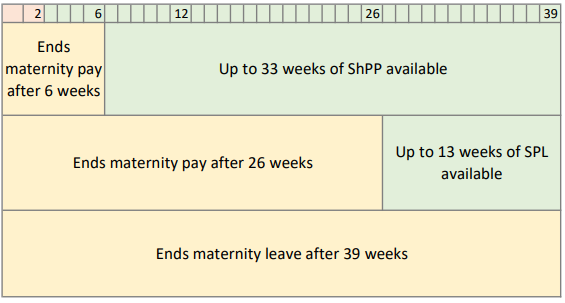

The first two weeks of maternity leave are compulsory, so partners can share or split up to 50 weeks of leave, as pictured below.

How to ‘create’ Shared Parental Pay

Shared Parental Pay (ShPP) is also created when the birth partner ends (‘curtails’) her maternity leave and/or maternity pay, to create an amount of leave available to her partner to take as SPL and ShPP.

Please note that as Statutory Maternity Pay (SMP) is paid at the higher rate of 90% of the mother’s average earnings for the first 6 weeks whereas Shared Parental Pay is only paid at the statutory rate, the mother will generally be better off staying on maternity leave for at least the first 6 weeks.

The first two weeks of maternity pay are compulsory, so partners can share or split up to 37 weeks of pay, as pictured below.

How leave can be shared

SPL can be taken in any way eligible parents would like, as long as leave is taken within the first year of birth (or adoption) and it is within the rules of the scheme.

For instance:

- Both parents can use SPL to stay off work at the same time

- Both parents can use SPL and stay off work at different times

- The birth parent can return to work early and take SPL at a later date

- The birth parent can return to work early and her partner can take SPL

- The birth parent can curtail their maternity leave in order to create SPL to allow them to return to work for periods in between periods of SPL . There is no requirement for both parents to take SPL.

The non-birth partner can start their SPL as soon as the child has been born and while the birth parent is still on maternity leave, as long as the birth parent has committed to end her leave early (by serving a notice of curtailment on her employer or on Jobcentre Plus if she is receiving Maternity Allowance).

Non-birth partners can take paternity leave before starting their SPL.

For more information on how to book SPL, see our article on notice and booking.

Examples of sharing leave

This section explains some common examples of how partners can share leave.

Example 1: Birth mother returns to work after 39 weeks and shares unpaid leave with partner

This is a common way for partners to share leave. The birth partner takes 39 weeks of leave with pay, and chooses to return to work once the paid portion of maternity leave ends.

If she curtails her maternity leave by 13 weeks, she has up to 13 weeks that she can share with her partner. Her partner can take this leave whenever they would like – either after their paternity leave, or after their partner returns to work.

Example 2: Partners want to share leave equally

This is also a common way for partners to choose to share leave. The birth partner commits to end her maternity leave and pay after 26 weeks, to create an entitlement to 26 weeks of leave and 13 weeks of pay for her partner to take.

Her partner can take this leave at the same time, or after the birth mother returns to work.

Example 3: Partner wants to take leave in ‘blocks’

This is also a common way for partners to choose to share leave. The partners want to share leave equally, and the birth mother ends her maternity leave and pay after 26 weeks, but her partner takes their entitlement in two blocks.

In this example, the partner has taken 13 weeks of SPL and ShPP after paternity leave, and a second block of 13 weeks of unpaid SPL after the birth mother returns to work.

Things to consider when deciding how to share leave

- Do you want to share the caring of your child with your partner in the first year?

- Do you want time off together or separately?

- Do you want to take leave all at once, or in blocks throughout the year, returning to work in between?

- Do you or your partner need to work during the first year for financial reasons?

- Are you are entitled to enhanced maternity pay or is your partner entitled to enhanced parental pay?

- As SMP is paid at the higher rate of 90% of the mother’s average earnings for the first 6 weeks whereas Shared Parental Pay is only paid at the statutory rate, the mother will generally be better off staying on maternity leave for at least the first 6 weeks.

Some advantages of taking SPL include:

- It can be shared between partners, allowing them to stay off work at the same time or at different times

- You can return to work, and go back on leave (unlike maternity leave, which cannot be restarted once ended)

- It can be taken in up to three ‘blocks’ (or more if your employer agrees)

- Employees on SPL can work up to 20 ‘SPLIT’, whereas those on maternity leave can only work up to 10 ‘KIT’ days

- An employee can use SPL to take paid holiday during their leave period, to boost their pay while they are off work

This advice applies in England, Wales and Scotland. If you live in another part of the UK, the law may differ. Please call our helpline for more details. If you are in Northern Ireland you can visit the Labour Relations Agency or call their helpline Workplace Information Service on 03300 555 300.

If you have further questions and would like to contact our advice team please use our advice contact form below or call us.

This probably isn’t what you came here for.

You’re looking for answers – maybe even a lifeline. And we’re proud to be able to offer free legal advice to parents and carers who need it.

But keeping this service free, expert, and up to date takes time, people, and funding.

- We’re a small charity, not a big law firm. That means we can focus on helping parents and carers, not chasing fees.

- It also means we’re free to speak up, using what we learn to campaign for fairer workplace rights for all families.

- And it means we can keep our advice free and accessible for those who need it most, not hidden behind a paywall or limited to those who can afford a solicitor.

Most people who visit our site won’t donate – and that’s okay. But if you’re in a position to chip in, we’d be hugely grateful. Your support helps us keep showing up for families when it matters most.

Whatever you can give – thank you.

You’re helping build a fairer future for working families.

We would love your feedback

Would your employer benefit from support from Working Families?

Would your employer benefit from some support & guidance from Working Families? If you would like to make your employer aware of how Working Families can help them, we have an introduction letter template available that you can give to the relevant person in your organisation.

The information on the law contained on this site is provided free of charge and does not, and is not intended to, amount to legal advice to any person on a specific case or matter. If you are not a solicitor, you are advised to obtain specific legal advice about your case or matter and not to rely solely on this information. Law and guidance is changing regularly in this area.

We cannot provide advice on employment rights in Northern Ireland as the law is different. You can visit the Labour Relations Agency or call their helpline Workplace Information Service on 03300 555 300.